Are you searching for the Capital One phone number for credit card payment? You’re not alone. Many people find themselves needing to contact Capital One for various reasons, whether it’s to make a payment, resolve an issue, or inquire about their account. This guide will provide all the essential information you need to navigate this process effectively.

Capital One is one of the largest financial institutions in the United States, offering a wide range of financial products, including credit cards. With millions of customers relying on their services, it’s crucial to know how to reach them when necessary. Whether you're looking for customer service support or need assistance with your credit card payments, having the right phone number can make all the difference.

In this article, we’ll explore everything you need to know about the Capital One phone number for credit card payment, including how to use it, what to expect when you call, and additional resources that can help you manage your account efficiently. Let’s dive in!

Read also:Seneca Gaming And Entertainment Events The Ultimate Guide To Unforgettable Experiences

Table of Contents

- Capital One Overview

- Capital One Phone Number for Credit Card Payment

- Why Contact Capital One?

- Payment Options for Capital One Credit Cards

- Customer Service Experience

- Troubleshooting Common Issues

- Tips for Effective Communication

- Security and Privacy

- Frequently Asked Questions

- Conclusion

Capital One Overview

Capital One Financial Corporation is a multinational financial services company headquartered in McLean, Virginia. Founded in 1988, it has grown to become one of the largest banks in the United States, offering a variety of banking and credit services. Its credit card division is particularly popular, known for innovative features and competitive rewards programs.

Capital One provides several ways for customers to interact with their services, including online banking, mobile apps, and phone support. For those who prefer direct communication, knowing the appropriate Capital One phone number for credit card payment can be invaluable.

History of Capital One

Capital One’s journey began as an offshoot of Signet Bank, focusing on credit card lending. Over the years, the company expanded its product offerings and acquired several other financial institutions, solidifying its position in the market. Today, Capital One serves millions of customers across the globe, maintaining a reputation for customer-centric services.

Capital One Phone Number for Credit Card Payment

If you need to contact Capital One regarding your credit card payment, the primary phone number to use is 1-800-955-6600. This number is available 24/7 and connects you to their customer service team, where you can address any concerns or make payments over the phone.

It’s important to note that different services may have specific phone numbers. For instance, if you’re calling about fraud or lost cards, you might need to use a different line. Always refer to your credit card statement or the official Capital One website for the most accurate contact information.

Alternative Contact Numbers

- General Customer Service: 1-800-655-2265

- International Customers: 1-703-723-5663

- Cardholder Services: 1-800-955-0561

Why Contact Capital One?

There are numerous reasons why you might need to contact Capital One, especially regarding your credit card. Below are some common scenarios:

Read also:Where Did Terry Bradshaw Live Exploring The Iconic Nfl Stars Residences

- Make a Payment: If you prefer to pay your credit card bill over the phone, calling Capital One is a straightforward option.

- Dispute a Charge: If you notice unauthorized or incorrect charges on your statement, contacting customer service is essential.

- Request a Credit Limit Increase: You can inquire about increasing your credit limit by speaking directly to a representative.

- Report Lost or Stolen Cards: Immediate action is necessary if your card is missing or compromised.

Payment Options for Capital One Credit Cards

While calling Capital One is one way to make a payment, there are several other methods available:

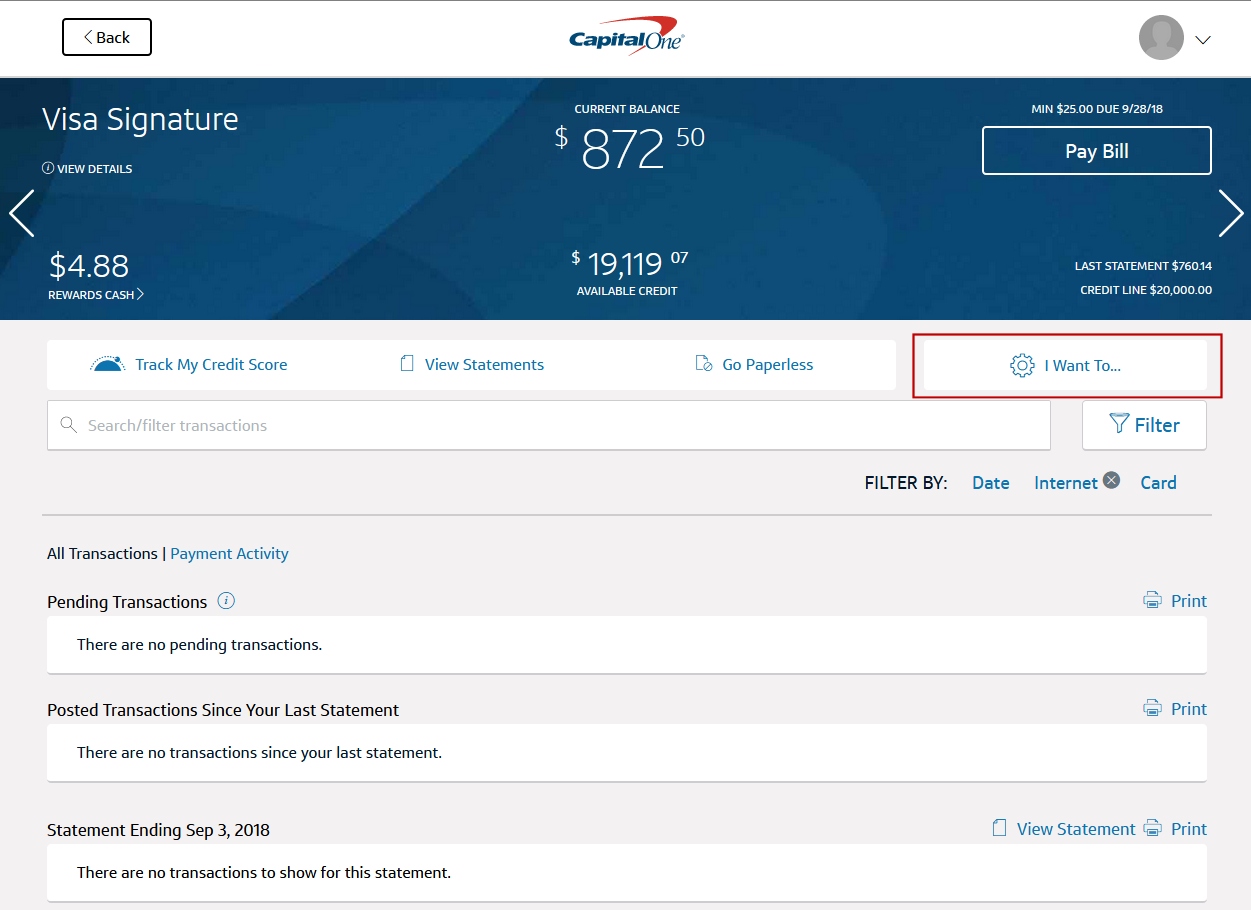

- Online Banking: Log in to your Capital One account through their website to schedule or make payments instantly.

- Mobile App: The Capital One mobile app offers a convenient way to manage your account and pay your bill on the go.

- Automatic Payments: Set up autopay to ensure your payments are made on time every month.

- Mail: Send a check to Capital One’s payment processing center, but be aware this method may take longer to process.

Advantages of Phone Payments

Calling Capital One to make a payment can be advantageous for those who prefer human interaction or need immediate assistance. Representatives can guide you through the process and answer any questions you might have.

Customer Service Experience

Capital One is known for its high-quality customer service. When you call their phone number for credit card payment, you can expect:

- Responsive Representatives: Trained professionals ready to assist you with your needs.

- Quick Resolution: Many issues can be resolved during the initial call, saving you time and hassle.

- 24/7 Availability: Customer service is available around the clock, ensuring you can reach them whenever necessary.

Best Practices for Calling Capital One

Here are some tips to enhance your experience when contacting Capital One:

- Have your account information handy, including your credit card number and billing address.

- Be clear about the purpose of your call to expedite the process.

- Stay patient and polite, as representatives are there to assist you.

Troubleshooting Common Issues

Even with excellent customer service, issues can arise. Below are some common problems and how to address them:

- Payment Not Processed: Verify the payment details and contact Capital One if the issue persists.

- Incorrect Billing: Review your statement carefully and report any discrepancies promptly.

- Technical Difficulties: If you experience issues with online or mobile payments, calling customer service can often resolve the problem.

When to Escalate Your Issue

If your concern isn’t resolved after speaking with a representative, don’t hesitate to request escalation to a supervisor. Capital One values customer satisfaction and will work diligently to address your concerns.

Tips for Effective Communication

Communicating effectively with Capital One’s customer service can lead to faster and more satisfactory resolutions. Consider the following tips:

- Prepare your questions or concerns in advance to ensure clarity.

- Keep notes of your interactions, including dates, times, and representative names.

- Follow up if necessary to ensure your issue is fully resolved.

Security and Privacy

Capital One prioritizes the security and privacy of its customers. When using their phone number for credit card payment, you can trust that your information is handled with the utmost care. Always ensure you’re calling from a secure location and avoid sharing sensitive details over unsecured networks.

Protecting Your Information

Here are some additional steps to safeguard your data:

- Regularly monitor your account for suspicious activity.

- Use strong, unique passwords for your online accounts.

- Enable two-factor authentication for added security.

Frequently Asked Questions

Q: Can I make a credit card payment over the phone?

A: Yes, you can make a payment by calling Capital One’s dedicated phone number for credit card payments.

Q: What are the operating hours for Capital One customer service?

A: Capital One customer service is available 24 hours a day, seven days a week.

Q: Is there a fee for making a payment over the phone?

A: Generally, there is no fee for paying your credit card bill over the phone. However, it’s always a good idea to confirm this with Capital One.

Conclusion

In summary, knowing the Capital One phone number for credit card payment is essential for managing your account effectively. Whether you’re making a payment, resolving an issue, or seeking general assistance, Capital One’s customer service team is equipped to help.

We encourage you to take advantage of the various resources available, including online banking, mobile apps, and phone support, to ensure your financial needs are met. If you found this guide helpful, please share it with others who might benefit from the information. Additionally, feel free to leave a comment or explore other articles on our site for more valuable insights.