Travis County real estate tax records are essential documents that provide critical information about property ownership, valuation, and taxation. Whether you're a homeowner, buyer, seller, or investor, understanding these records is vital for making informed decisions. This article delves into everything you need to know about Travis County's property tax records, ensuring you're well-prepared for your real estate journey.

Property taxes play a significant role in funding public services such as schools, infrastructure, and emergency services. In Travis County, Texas, these taxes are assessed based on property values, which are recorded and maintained by local authorities. By accessing these records, you can gain insights into property assessments, tax liabilities, and historical trends.

This guide is designed to provide detailed information about Travis County real estate tax records, including how to access them, what they contain, and why they matter. With a focus on clarity and practical advice, this article will equip you with the knowledge needed to navigate the complexities of property taxes in Travis County.

Read also:La Dodgers Score Yesterday A Comprehensive Recap And Analysis

Understanding Travis County Real Estate Tax Records

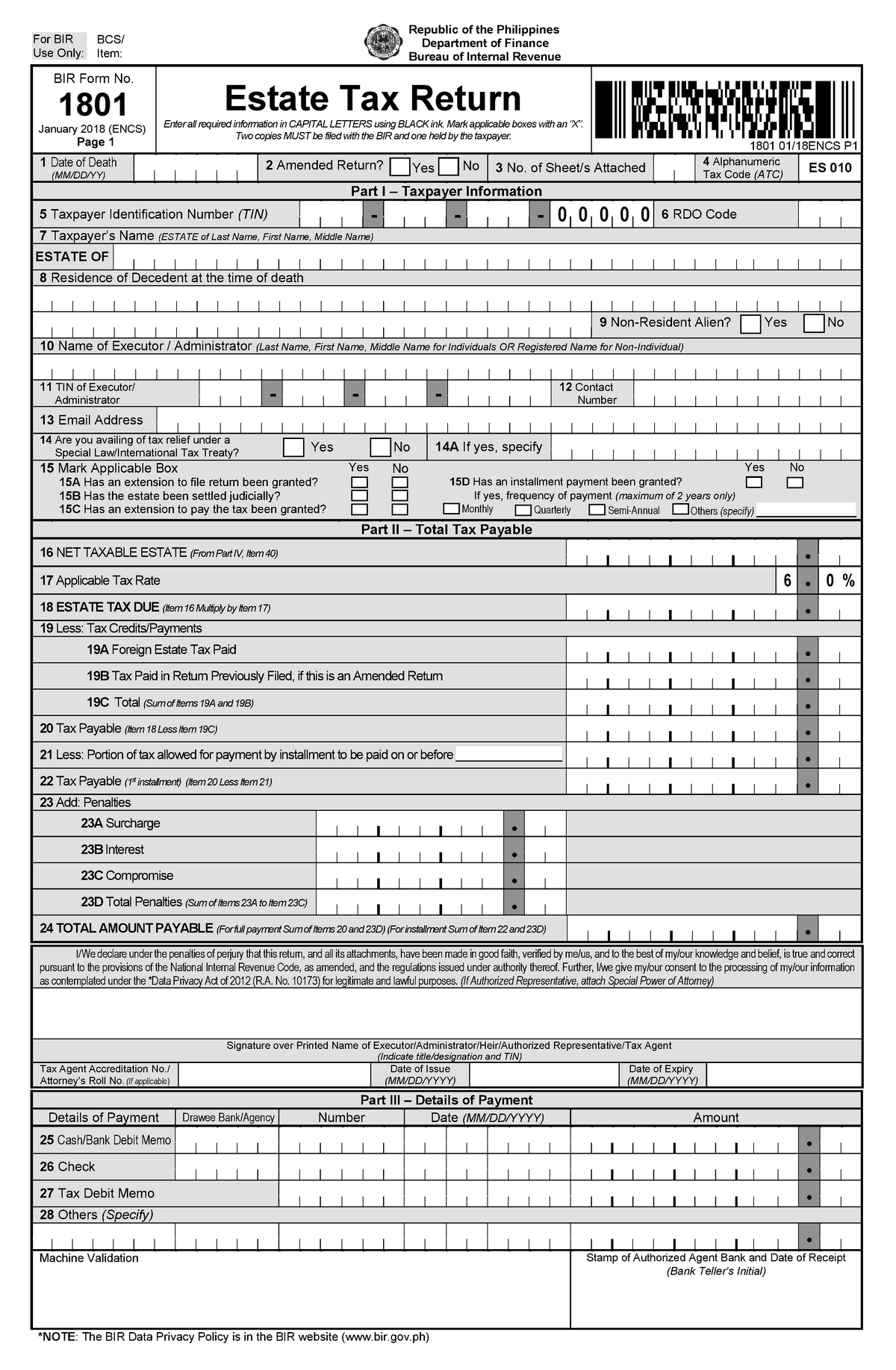

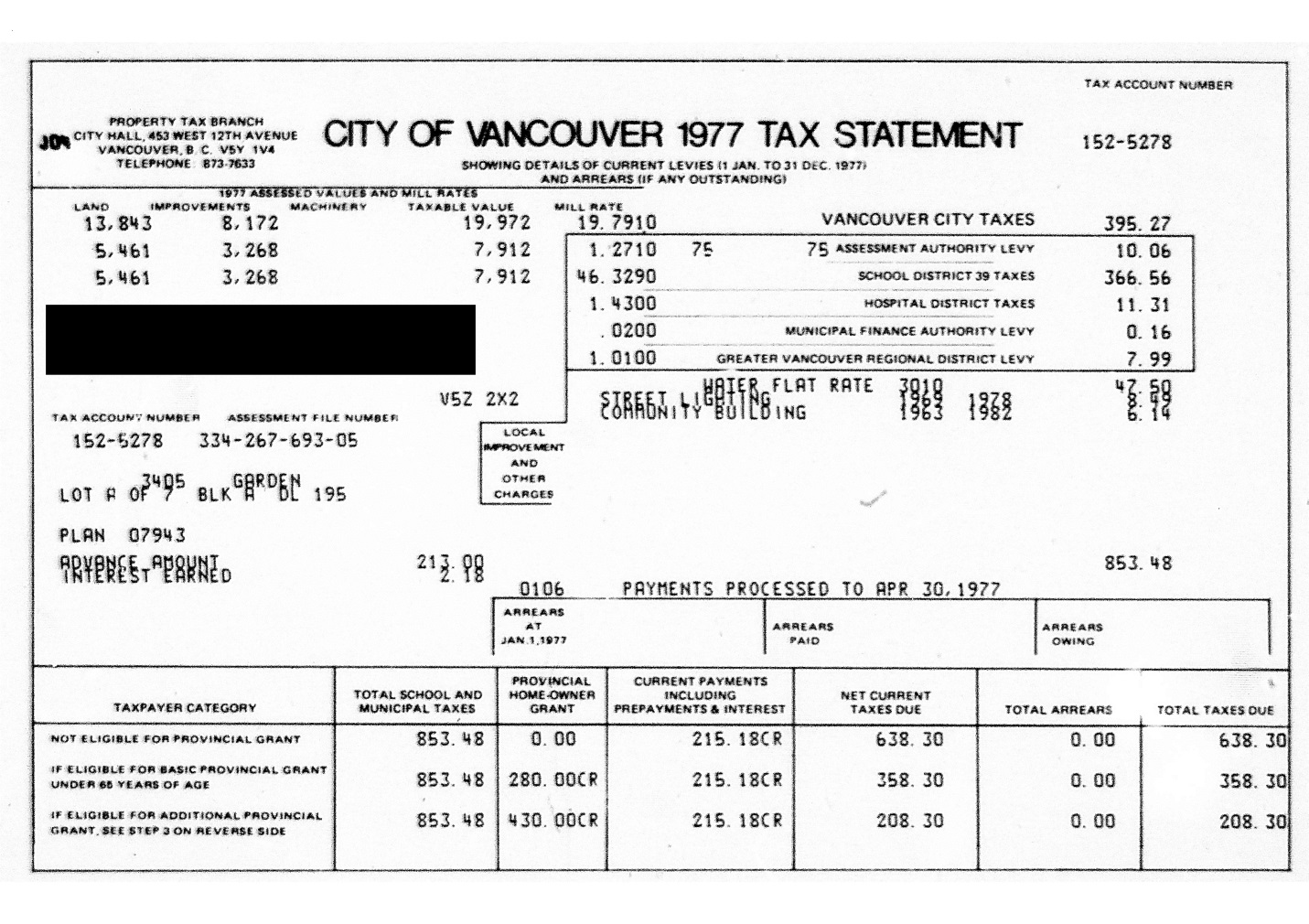

Travis County real estate tax records are official documents maintained by the Travis Central Appraisal District (CAD) and other local authorities. These records include property descriptions, assessed values, tax rates, and payment histories. Understanding these records is crucial for anyone involved in the real estate market.

Property tax records serve as a foundation for financial planning, legal transactions, and property management. They are updated annually to reflect changes in property values and ownership. By familiarizing yourself with these records, you can better understand your tax obligations and the factors influencing property assessments.

Key Components of Travis County Real Estate Tax Records

- Property Description: Detailed information about the property, including address, size, and zoning.

- Assessed Value: The estimated market value of the property used for tax calculations.

- Tax Rate: The percentage applied to the assessed value to determine the tax amount.

- Payment History: Records of past tax payments and any outstanding balances.

- Exemptions: Details about any tax exemptions or reductions applicable to the property.

Accessing Travis County Real Estate Tax Records

Obtaining Travis County real estate tax records is easier than ever, thanks to digital platforms and online portals. The Travis Central Appraisal District (CAD) provides a user-friendly website where property owners and the public can access these records.

To access the records, visit the official Travis CAD website and use the property search tool. You can search by address, owner name, or parcel number. This tool allows you to view detailed information about property assessments, tax rates, and payment histories.

Steps to Access Travis County Real Estate Tax Records

- Visit the Travis Central Appraisal District website.

- Navigate to the property search tool.

- Enter the property address, owner name, or parcel number.

- Review the available records, including assessed values and tax details.

Importance of Travis County Real Estate Tax Records

Travis County real estate tax records are more than just official documents; they play a pivotal role in the real estate ecosystem. These records help property owners understand their tax obligations, assist buyers in evaluating potential purchases, and provide investors with valuable market insights.

For homeowners, these records ensure transparency in property assessments and tax calculations. For buyers, they offer a clear picture of a property's financial history. And for investors, they serve as a tool for analyzing market trends and identifying profitable opportunities.

Read also:Kelsea Ballerini Songs A Journey Through Music And Stardom

How Travis County Real Estate Tax Records Impact Property Values

Property tax records influence property values by reflecting market conditions and economic trends. High tax assessments may indicate rising property values, while lower assessments could signal a slowdown in the market. Understanding these dynamics is essential for anyone involved in the real estate market.

Travis County Property Tax System Overview

The Travis County property tax system is governed by state laws and administered by local authorities. Property taxes are assessed based on the property's appraised value, which is determined annually by the Travis Central Appraisal District. These taxes fund essential services, including public education, infrastructure, and public safety.

Tax rates in Travis County vary depending on the taxing entities involved, such as schools, cities, and counties. Property owners receive annual tax bills detailing their obligations and payment deadlines. Failure to pay property taxes can result in penalties, liens, or even foreclosure.

Key Players in the Travis County Property Tax System

- Travis Central Appraisal District: Responsible for appraising property values.

- Taxing Entities: Local governments that set tax rates and collect revenues.

- Property Owners: Individuals or entities responsible for paying property taxes.

Challenges in Understanding Travis County Real Estate Tax Records

While Travis County real estate tax records are publicly available, interpreting them can be challenging for those unfamiliar with the system. Complex terminology, varying tax rates, and frequent updates can make it difficult to grasp the full picture. However, with the right resources and guidance, you can navigate these records effectively.

Common challenges include understanding the difference between assessed values and market values, deciphering tax codes, and identifying applicable exemptions. Overcoming these hurdles requires a combination of research, expert advice, and practical experience.

Tips for Interpreting Travis County Real Estate Tax Records

- Consult the Travis Central Appraisal District's website for definitions and explanations.

- Seek advice from local real estate professionals or tax experts.

- Compare records with similar properties to identify trends and discrepancies.

Legal Aspects of Travis County Real Estate Tax Records

Understanding the legal framework surrounding Travis County real estate tax records is essential for ensuring compliance and protecting your rights. Property owners have the right to appeal their assessments if they believe the appraised value is inaccurate. Additionally, failure to pay property taxes can lead to legal consequences, including property liens or foreclosure.

It's important to stay informed about changes in property tax laws and regulations. Regularly reviewing your tax records and staying in communication with local authorities can help you avoid potential issues.

Appealing Property Tax Assessments in Travis County

If you believe your property's assessed value is inaccurate, you can file an appeal with the Travis Central Appraisal District. The process involves submitting a protest form, gathering evidence to support your case, and attending a hearing if necessary. Understanding your rights and following the proper procedures can lead to a successful appeal.

Impact of Economic Factors on Travis County Real Estate Tax Records

Economic conditions significantly influence Travis County real estate tax records. Factors such as population growth, job creation, and housing demand affect property values and, consequently, tax assessments. Understanding these dynamics can help you make informed decisions about buying, selling, or investing in real estate.

For example, during periods of economic growth, property values may rise, leading to higher tax assessments. Conversely, economic downturns can result in lower property values and reduced tax revenues. Staying informed about economic trends is crucial for navigating the real estate market effectively.

Monitoring Economic Trends in Travis County

To stay updated on economic trends affecting Travis County real estate tax records, consider the following resources:

- Local government reports and publications.

- Economic research from universities and think tanks.

- News articles and analyses from reputable sources.

Future Developments in Travis County Real Estate Tax Records

The landscape of Travis County real estate tax records is continually evolving. Advances in technology, changes in legislation, and shifting economic conditions are likely to impact how these records are maintained and accessed. Staying informed about these developments can help you remain prepared for the future.

For instance, digital innovations may enhance the accessibility and accuracy of property tax records. Additionally, new laws or regulations could alter the way property taxes are assessed and collected. Keeping up with these changes is essential for anyone involved in the real estate market.

Preparing for Changes in Travis County Real Estate Tax Records

To prepare for future developments, consider the following strategies:

- Stay informed about legislative updates and technological advancements.

- Engage with local authorities and industry experts for insights and advice.

- Regularly review your property tax records to ensure accuracy and compliance.

Conclusion

Travis County real estate tax records are a vital component of the real estate ecosystem, providing critical information for property owners, buyers, sellers, and investors. By understanding these records and how they impact property values and tax obligations, you can make informed decisions and navigate the market with confidence.

We encourage you to explore the resources mentioned in this article and stay updated on the latest developments in Travis County's property tax system. Feel free to leave comments, ask questions, or share this article with others who may find it helpful. Together, let's build a stronger understanding of Travis County's real estate landscape.

Table of Contents

- Understanding Travis County Real Estate Tax Records

- Accessing Travis County Real Estate Tax Records

- Importance of Travis County Real Estate Tax Records

- Travis County Property Tax System Overview

- Challenges in Understanding Travis County Real Estate Tax Records

- Legal Aspects of Travis County Real Estate Tax Records

- Impact of Economic Factors on Travis County Real Estate Tax Records

- Future Developments in Travis County Real Estate Tax Records

- Conclusion