State Farm insurance liability coverage is an essential component of any driver's financial protection strategy. As one of the leading insurance providers in the United States, State Farm offers a wide range of liability coverage options designed to safeguard drivers from unexpected legal and financial challenges. Whether you're a new driver or a seasoned one, understanding liability coverage is crucial to making informed decisions about your insurance needs.

When it comes to car insurance, liability coverage is often the most misunderstood aspect. Many drivers believe that purchasing the minimum required coverage is sufficient, but this can lead to significant financial risks. This article aims to demystify State Farm's liability coverage options, helping you make the best choice for your unique situation.

By the end of this guide, you will have a clear understanding of what liability coverage entails, how it works with State Farm, and why it is vital for protecting your assets. Whether you're looking for basic coverage or need additional protections, we'll break down everything you need to know.

Read also:Who Sang The Song Red Red Wine A Comprehensive Guide To The Iconic Song And Its History

Table of Contents

- Introduction to State Farm Insurance Liability Coverage

- What is Liability Coverage?

- State Farm's Liability Coverage Options

- Why Liability Coverage is Important

- Factors Affecting the Cost of Liability Coverage

- State Laws and Liability Requirements

- The State Farm Claims Process for Liability

- Additional Protections Offered by State Farm

- Tips for Choosing the Right Liability Coverage

- Common Mistakes to Avoid

- Conclusion

Introduction to State Farm Insurance Liability Coverage

State Farm is one of the largest insurance providers in the United States, known for its extensive network of agents and comprehensive insurance products. Among its offerings, liability coverage stands out as a critical component of its auto insurance policies. This type of coverage protects drivers from financial losses arising from accidents where they are deemed at fault.

Liability coverage is mandatory in most states, ensuring that drivers can cover damages or injuries caused to others. State Farm offers flexible options, allowing policyholders to tailor their coverage to their specific needs. From basic coverage to enhanced protections, State Farm ensures drivers are well-equipped to handle the unexpected.

What is Liability Coverage?

Definition and Purpose

Liability coverage is a fundamental part of auto insurance that covers damages and injuries you cause to others in an accident. It does not cover damages to your vehicle or personal injuries. Instead, it focuses on providing financial protection for the other party involved in the incident.

There are two main types of liability coverage:

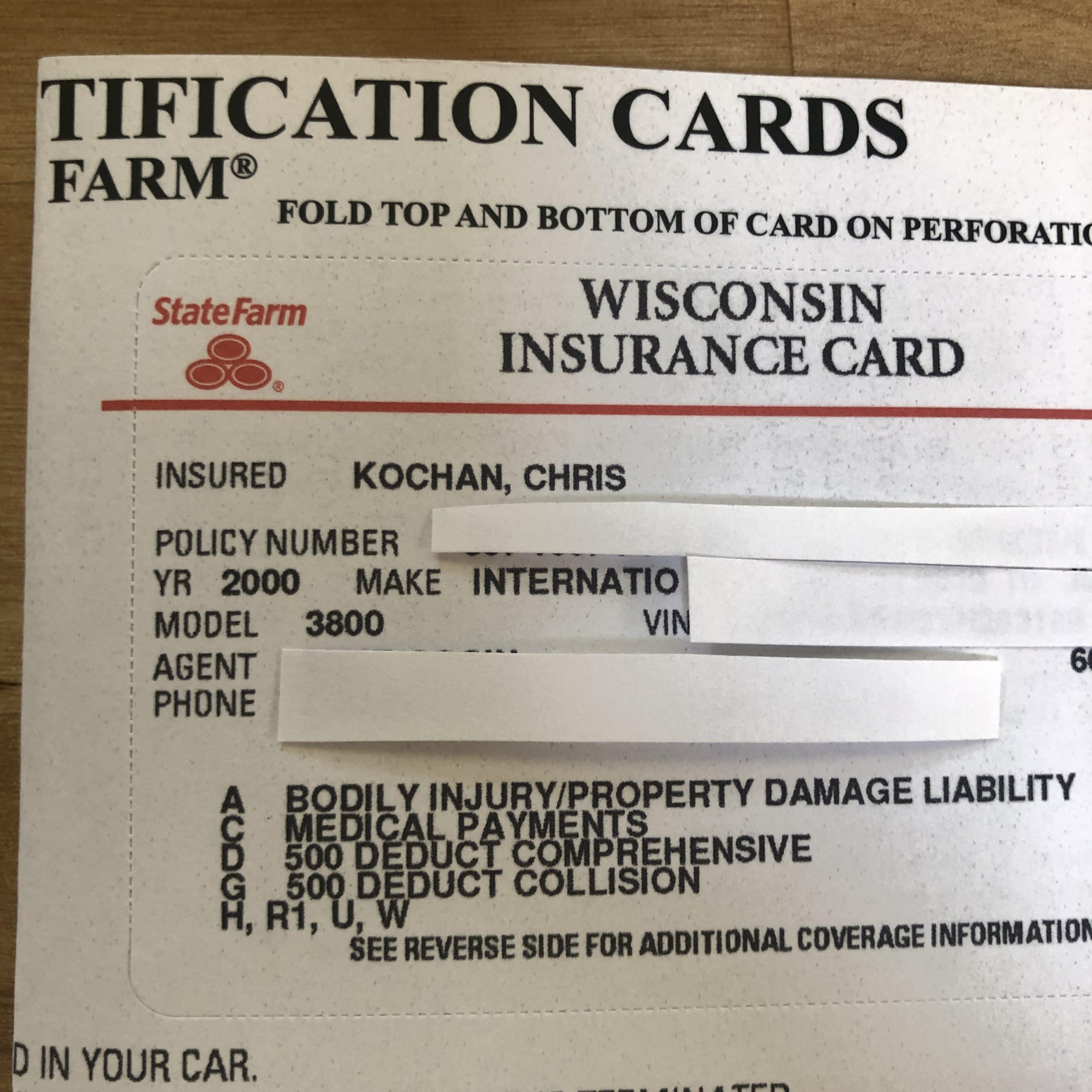

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident where you are at fault.

- Property Damage Liability: Covers repairs or replacements for damaged property, such as vehicles, fences, or buildings.

How It Works

When an accident occurs, liability coverage kicks in if you are found at fault. State Farm will handle claims filed against you, ensuring that the other party receives compensation for their losses. This coverage helps protect your assets from being seized to pay for damages or legal fees.

State Farm's Liability Coverage Options

State Farm offers various levels of liability coverage to suit different drivers' needs. Policyholders can choose from basic minimum coverage to higher limits for added protection. Here's a breakdown of the options:

Read also:What Nationality Are Elon Musks Parents A Comprehensive Exploration

- Minimum Liability Coverage: Meets state requirements but offers limited protection.

- Standard Liability Coverage: Provides a balance between cost and protection.

- High-Limit Liability Coverage: Ideal for drivers with significant assets who need extra protection.

Choosing the right level of coverage depends on your financial situation, driving history, and the value of your assets.

Why Liability Coverage is Important

Protecting Your Assets

Accidents can happen to anyone, and the financial consequences can be severe. Without adequate liability coverage, you could face lawsuits, judgments, or liens on your property. State Farm's liability coverage acts as a safety net, shielding your assets from potential financial ruin.

Compliance with State Laws

Most states require drivers to carry a minimum level of liability coverage. Failure to comply can result in fines, license suspension, or even imprisonment. By choosing State Farm, you ensure that you meet all legal requirements while enjoying peace of mind.

Factors Affecting the Cost of Liability Coverage

The cost of liability coverage varies depending on several factors:

- Driving Record: A clean driving record typically results in lower premiums.

- Location: Drivers in urban areas may pay more due to higher accident rates.

- Vehicle Type: Luxury or high-performance vehicles may increase liability costs.

- Coverage Limits: Higher limits generally mean higher premiums but better protection.

State Farm's agents can help you find the best balance between cost and coverage based on your individual circumstances.

State Laws and Liability Requirements

Understanding State-Specific Regulations

Each state has its own minimum liability coverage requirements. For example:

- Florida: Requires $10,000 in property damage liability but no bodily injury liability mandate.

- Texas: Requires $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

State Farm ensures compliance with all state laws, making it easier for drivers to meet legal obligations.

The State Farm Claims Process for Liability

Reporting an Accident

After an accident, it's crucial to report it to State Farm promptly. Their claims process is designed to be efficient and straightforward:

- Contact your State Farm agent or use the mobile app to initiate a claim.

- Provide details about the accident, including photos and witness statements if available.

- State Farm will assign a claims adjuster to evaluate the situation and determine liability.

Receiving Compensation

Once liability is established, State Farm will pay the appropriate compensation to the affected party. This ensures that you avoid out-of-pocket expenses and potential legal issues.

Additional Protections Offered by State Farm

Uninsured/Underinsured Motorist Coverage

In addition to liability coverage, State Farm offers uninsured/underinsured motorist coverage. This protects you if you're involved in an accident with a driver who lacks sufficient insurance.

Rental Car Reimbursement

State Farm also provides rental car reimbursement coverage, which helps cover the cost of renting a vehicle while your car is being repaired after an accident.

Tips for Choosing the Right Liability Coverage

Selecting the appropriate liability coverage involves evaluating your financial situation and risk tolerance. Here are some tips:

- Assess your assets and choose coverage limits that adequately protect them.

- Review your driving history and adjust coverage accordingly.

- Consider umbrella policies for additional protection if needed.

Consulting with a State Farm agent can provide personalized recommendations based on your unique needs.

Common Mistakes to Avoid

Underestimating Coverage Needs

One of the most common mistakes drivers make is opting for the minimum required liability coverage. This can leave them vulnerable to significant financial losses in the event of a serious accident.

Not Reviewing Policies Regularly

Your insurance needs may change over time due to factors like increased wealth, family size, or driving habits. Regularly reviewing your policy with a State Farm agent ensures that your coverage remains appropriate.

Conclusion

State Farm insurance liability coverage is an indispensable tool for protecting your financial future. By understanding the basics of liability coverage, exploring State Farm's offerings, and making informed decisions, you can safeguard yourself and your loved ones from the unexpected.

We encourage you to take action by reviewing your current policy or contacting a State Farm agent to discuss your options. Don't forget to share this article with others who may benefit from the information. Together, let's promote safe driving and responsible insurance practices.

For more insights into State Farm's products and services, explore our other articles or visit your local State Farm office. Your peace of mind is our priority!