Living in Hawaii may seem like a dream come true, but understanding the cost of living is crucial before making the move. Hawaii offers breathtaking landscapes, pristine beaches, and a unique cultural experience, but it also comes with a higher price tag compared to many other U.S. states. Whether you're planning to relocate or simply curious about the expenses, this guide will break down everything you need to know about living costs in Hawaii.

Hawaii’s allure as a tropical paradise attracts millions of visitors and potential residents each year. However, the cost of living in Hawaii is significantly higher than the national average. Factors such as remoteness, import dependency, and high demand contribute to this elevated expense. Understanding these factors is essential for anyone considering a move to the Aloha State.

In this comprehensive article, we’ll explore the various aspects of living costs in Hawaii, including housing, groceries, transportation, healthcare, and entertainment. By the end of this guide, you’ll have a clear picture of what to expect financially and how to plan accordingly for a life in paradise.

Read also:Where Did Terry Bradshaw Live Exploring The Iconic Nfl Stars Residences

Table of Contents

- Housing Costs in Hawaii

- Groceries and Food Expenses

- Transportation Costs

- Healthcare Costs

- Utility Expenses

- Education Costs

- Entertainment and Leisure

- Taxes in Hawaii

- Tips for Saving Money in Hawaii

- Conclusion and Final Thoughts

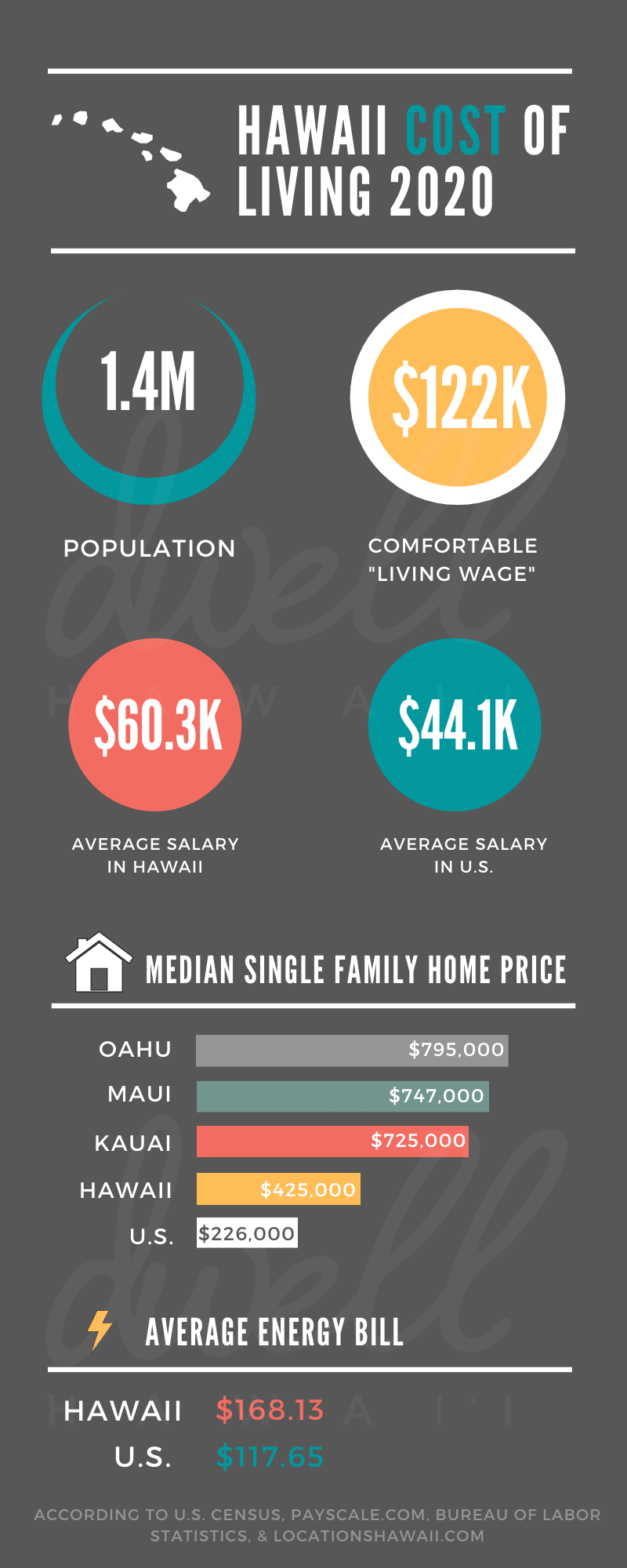

Housing Costs in Hawaii

Housing is one of the most significant expenses when it comes to the cost of living in Hawaii. The state's limited land availability and high demand drive up property prices and rental costs. As of 2023, the median home price in Hawaii is approximately $800,000, which is significantly higher than the national average.

Homeownership vs. Renting

Deciding between homeownership and renting depends on your financial situation and long-term plans. Below are some key points to consider:

- Homeownership: If you plan to stay in Hawaii long-term, buying a home could be a wise investment, despite the high initial cost.

- Renting: For those unsure about committing to a permanent move, renting offers more flexibility but comes with consistently high monthly expenses.

Data from the U.S. Census Bureau shows that rental prices in Hawaii are among the highest in the nation, with an average one-bedroom apartment costing around $2,000 per month.

Groceries and Food Expenses

Groceries in Hawaii are notoriously expensive due to the state's reliance on imports. Most food items are shipped in from the mainland, adding to the cost. On average, residents spend about 30% more on groceries compared to the rest of the U.S.

Tips for Reducing Grocery Bills

- Shop at local farmers' markets for fresh produce at lower prices.

- Buy in bulk when possible, especially for non-perishable items.

- Utilize discount stores like Costco or Sam's Club for cost-effective purchasing.

According to a study by the Hawaii Food Policy Council, supporting local agriculture not only reduces costs but also promotes sustainability.

Transportation Costs

Transportation expenses in Hawaii vary depending on your location and lifestyle. Public transportation options are limited, especially on smaller islands, so owning a car is often necessary. Gas prices in Hawaii are among the highest in the nation due to import costs.

Read also:Hampton Inn Hilton Head The Ultimate Guide To Your Hilton Head Island Getaway

Alternative Transportation Options

- Use ride-sharing services like Uber or Lyft for occasional trips.

- Explore public buses, particularly on Oahu, where the system is more developed.

- Consider biking or walking in urban areas to save money.

A report by the Hawaii Department of Transportation highlights the ongoing efforts to improve public transit systems across the islands.

Healthcare Costs

Healthcare expenses in Hawaii are generally lower than the national average thanks to the state's Prepaid Health Care Act, which mandates employer-provided health insurance for most workers. However, out-of-pocket costs and premiums can still be significant.

Key Factors Affecting Healthcare Costs

- Employer-provided insurance coverage.

- Private insurance plans for self-employed individuals.

- Out-of-pocket expenses for medications and treatments.

According to the Hawaii Health Connector, residents have access to affordable healthcare options through the state's insurance exchange program.

Utility Expenses

Utility costs in Hawaii are influenced by the state's reliance on imported energy sources. Electricity rates are among the highest in the U.S., primarily due to the use of oil-based power generation. However, renewable energy initiatives are gradually reducing these costs.

Ways to Reduce Utility Bills

- Invest in energy-efficient appliances and lighting.

- Take advantage of solar power incentives offered by the state.

- Practice energy conservation habits, such as turning off lights and unplugging unused devices.

Data from the Hawaii Energy Office shows a steady increase in solar panel installations, helping residents save on electricity bills.

Education Costs

Education in Hawaii offers a mix of public and private options. Public schools are funded by the state, providing free education for residents. Private schools, however, can be expensive, with tuition fees ranging from $8,000 to $20,000 per year depending on the institution.

Higher Education Opportunities

- University of Hawaii system offers affordable tuition rates for in-state students.

- Scholarships and financial aid programs are available to help offset costs.

- Community colleges provide cost-effective pathways to higher education.

The University of Hawaii's financial aid office reports a growing number of students receiving assistance to pursue their educational goals.

Entertainment and Leisure

Hawaii offers a wide range of entertainment options, from cultural festivals to outdoor adventures. While some activities are free or low-cost, others can add up quickly. Understanding the local entertainment scene can help you budget accordingly.

Free and Affordable Activities

- Visit state parks and beaches for free or low-cost entry fees.

- Attend community events and cultural festivals throughout the year.

- Explore hiking trails and natural landmarks at little to no expense.

The Hawaii Tourism Authority provides a comprehensive calendar of events, making it easy to find affordable entertainment options.

Taxes in Hawaii

Taxes in Hawaii include general excise tax (GET), real property tax, and income tax. The GET is applied to most goods and services, adding approximately 4.16% to your purchases. Real property taxes vary by county, while income tax rates are progressive, depending on your earnings.

Tax Incentives and Deductions

- Take advantage of tax credits for renewable energy installations.

- Claim deductions for home office expenses if you work remotely.

- Utilize state-specific tax breaks for education and healthcare expenses.

The Hawaii Department of Taxation offers detailed information on tax laws and available incentives for residents.

Tips for Saving Money in Hawaii

Living in Hawaii doesn't have to break the bank if you adopt smart financial strategies. Below are some practical tips for saving money while enjoying island life:

Money-Saving Strategies

- Create a detailed budget and stick to it.

- Buy locally produced goods to reduce costs and support the community.

- Utilize free or low-cost entertainment options, such as parks and beaches.

- Take advantage of tax incentives and deductions offered by the state.

By implementing these strategies, you can enjoy the beauty of Hawaii without compromising your financial well-being.

Conclusion and Final Thoughts

Living in Hawaii offers a unique lifestyle filled with natural beauty and cultural richness, but it also comes with a higher cost of living. Understanding the various expenses, from housing and groceries to healthcare and entertainment, is essential for anyone considering a move to the Aloha State. By planning carefully and adopting cost-saving strategies, you can make the most of your Hawaiian experience.

We encourage you to share your thoughts and experiences in the comments below. Have you lived in Hawaii? What tips do you have for managing living costs? Don't forget to explore our other articles for more insights into life in paradise. Thank you for reading, and mahalo for supporting our content!