ABA same as routing number is a term that frequently arises in banking and financial transactions. If you're navigating the world of banking, understanding what this means and how it impacts your financial dealings is crucial. In this article, we will explore the concept of ABA routing numbers, their significance, and how they relate to various banking processes.

Routing numbers are essential for ensuring smooth and secure financial transactions. They act as a digital address that identifies the financial institution involved in the transaction. Whether you're setting up direct deposits, sending wire transfers, or paying bills online, knowing your ABA routing number is essential.

This article aims to provide a comprehensive overview of ABA routing numbers, their role in banking, and how they function in various financial operations. By the end of this guide, you'll have a clear understanding of the importance of these numbers and how they impact your financial transactions.

Read also:Discover The Marriott At University Of Dayton Your Ultimate Guide

Table of Contents

- ABA Routing Number Overview

- ABA Same as Routing Number

- History of ABA Routing Numbers

- Structure of ABA Routing Numbers

- Uses of ABA Routing Numbers

- How to Find Your ABA Routing Number

- Common Questions About ABA Routing Numbers

- Differences Between ABA and Other Routing Numbers

- Security Considerations for ABA Routing Numbers

- Conclusion

ABA Routing Number Overview

ABA routing numbers, also known as ABA RTN (American Bankers Association Routing Transit Number), are nine-digit codes assigned to financial institutions in the United States. These numbers play a critical role in identifying the specific bank or credit union involved in a transaction.

Importance of ABA Routing Numbers

ABA routing numbers ensure that funds are transferred accurately between accounts. They are used in various banking operations, including direct deposits, electronic funds transfers (EFT), and wire transfers. Without a valid routing number, financial transactions could lead to errors or delays.

Where Are ABA Routing Numbers Used?

- Direct deposits for payroll

- Automated Clearing House (ACH) transactions

- Wire transfers

- Bill payments

ABA Same as Routing Number

The phrase "ABA same as routing number" refers to the fact that ABA routing numbers and routing transit numbers are essentially the same thing. The terms are often used interchangeably in banking terminology. Understanding this equivalence is important when filling out forms or communicating with financial institutions.

For example, when setting up a direct deposit or initiating an electronic funds transfer, you may be asked for your "routing number" or "ABA routing number." Both terms refer to the same nine-digit code assigned to your bank.

Read also:How Far Is A 5k Marathon Unveiling The Distance Benefits And Training Tips

History of ABA Routing Numbers

The concept of ABA routing numbers dates back to 1910 when the American Bankers Association (ABA) developed the system to streamline check processing. Initially, these numbers were used to identify the bank or financial institution that issued a check. Over time, their use expanded to include electronic transactions.

Evolution of ABA Routing Numbers

With advancements in technology, ABA routing numbers have become integral to modern banking systems. They are now used not only for check processing but also for electronic funds transfers, direct deposits, and wire transfers. The Federal Reserve Bank plays a key role in maintaining and regulating the routing number system.

Structure of ABA Routing Numbers

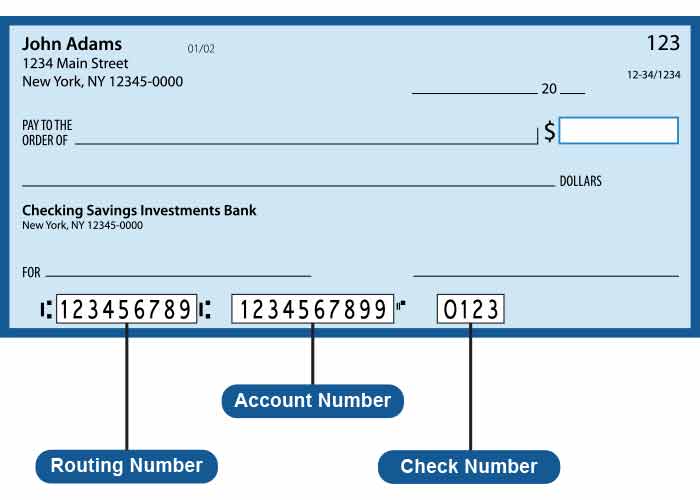

ABA routing numbers consist of nine digits, each with a specific purpose. The structure of these numbers ensures accuracy and security in financial transactions. Below is a breakdown of the components:

- First four digits: Represent the Federal Reserve Routing Symbol.

- Next four digits: Identify the bank or financial institution.

- Ninth digit: Acts as a checksum to verify the validity of the routing number.

How the Checksum Works

The checksum is calculated using a specific algorithm to ensure the routing number is accurate. Banks and financial institutions use this checksum to validate routing numbers before processing transactions.

Uses of ABA Routing Numbers

ABA routing numbers are used in a variety of financial transactions. Understanding their applications can help you navigate banking processes more effectively.

Direct Deposits

Direct deposits are one of the most common uses of ABA routing numbers. Employers use these numbers to deposit salaries directly into employees' bank accounts. This method is secure, efficient, and widely adopted.

Wire Transfers

Wire transfers require accurate routing numbers to ensure funds are transferred to the correct account. These transfers are often used for large transactions, such as purchasing real estate or transferring funds internationally.

How to Find Your ABA Routing Number

Finding your ABA routing number is straightforward. Here are several methods you can use:

- Check: The routing number is printed on the bottom left corner of your checks.

- Online Banking: Most banks provide routing numbers through their online banking portals.

- Bank Statement: Your routing number may appear on your monthly bank statement.

- Bank's Website: Many banks list routing numbers on their official websites.

What to Do If You Can't Find Your Routing Number

If you're unable to locate your routing number, contact your bank's customer service department. They can provide you with the correct number for your specific account type.

Common Questions About ABA Routing Numbers

Many people have questions about ABA routing numbers. Below are some frequently asked questions:

- Can routing numbers change? Yes, banks may change routing numbers due to mergers or acquisitions.

- Are routing numbers the same for all branches of a bank? Not always. Some banks use different routing numbers for different branches.

- Is it safe to share my routing number? Yes, but only with trusted entities like employers or financial institutions.

Differences Between ABA and Other Routing Numbers

While ABA routing numbers are widely used, other types of routing numbers exist. For example, SWIFT codes are used for international wire transfers, while IBANs are used in Europe. Understanding the differences between these systems is important for global financial transactions.

ABA vs. SWIFT Codes

ABA routing numbers are primarily used for domestic transactions within the United States, whereas SWIFT codes are used for international transfers. Both systems ensure secure and accurate fund transfers but serve different purposes.

Security Considerations for ABA Routing Numbers

While ABA routing numbers are generally safe to share, it's important to exercise caution. Avoid sharing your routing number with untrusted sources to prevent unauthorized access to your accounts.

Best Practices for Protecting Your Routing Number

- Only share your routing number with verified entities.

- Monitor your bank statements regularly for unauthorized transactions.

- Use secure channels when sharing sensitive financial information.

Conclusion

In conclusion, understanding the concept of ABA same as routing number is essential for anyone involved in banking and financial transactions. These nine-digit codes play a critical role in ensuring accurate and secure fund transfers. By knowing how to find and use your ABA routing number, you can navigate the banking system with confidence.

We encourage you to leave a comment or share this article with others who may find it helpful. For more information on banking and finance, explore our other articles on the website. Remember, staying informed is the key to managing your finances effectively.

Data Source: Federal Reserve Board, American Bankers Association.