Understanding financial terms such as routing numbers and ABA numbers is essential for managing your finances effectively. Whether you're setting up direct deposits, initiating wire transfers, or managing online banking, these numbers play a crucial role. Many people often wonder if a routing number is the same as an ABA number. This article will provide you with a clear understanding of these concepts and their differences.

In today's digital age, financial literacy is more important than ever. With the rise of online banking and digital transactions, understanding the nuances of banking terms can help you navigate the financial world with confidence. This article will delve into the intricacies of routing numbers and ABA numbers, ensuring you have all the information you need.

By the end of this article, you'll have a solid grasp of what routing numbers and ABA numbers are, how they function, and their significance in banking transactions. Let's dive in!

Read also:Current Omaha Weather Conditions Your Ultimate Guide For Staying Informed

Table of Contents:

- What is a Routing Number?

- What is an ABA Number?

- Difference Between Routing and ABA Numbers

- How to Find Your Routing Number

- Importance of Routing Numbers

- ABA Number Usage

- Common Mistakes to Avoid

- Frequently Asked Questions

- Historical Background of Routing Numbers

- Conclusion

What is a Routing Number?

A routing number, also known as a routing transit number (RTN), is a nine-digit code used by banks and financial institutions in the United States. It serves as an identifier for financial institutions and helps facilitate the processing of financial transactions. Routing numbers are primarily used for domestic transactions within the U.S.

Key Features of Routing Numbers

- Nine-Digit Code: Routing numbers are always nine digits long.

- Bank Identification: They uniquely identify a specific bank or financial institution.

- Transaction Processing: Routing numbers are used for processing checks, automated clearing house (ACH) transactions, and wire transfers.

Routing numbers are essential for ensuring that funds are directed to the correct financial institution. Without them, transactions would lack the necessary information to complete successfully.

What is an ABA Number?

An ABA number is essentially the same as a routing number. The term "ABA" stands for American Bankers Association, which originally developed the routing number system. ABA numbers are also nine-digit codes that identify banks and financial institutions.

ABA Number and Its Role

- Historical Origin: ABA numbers were first introduced in 1910 by the American Bankers Association.

- Domestic Transactions: Like routing numbers, ABA numbers are primarily used for domestic transactions within the U.S.

- Interchangeable Terms: In most contexts, the terms "routing number" and "ABA number" are used interchangeably.

While the terms may differ slightly in some financial contexts, they refer to the same nine-digit code used for banking transactions.

Difference Between Routing and ABA Numbers

Although the terms "routing number" and "ABA number" are often used interchangeably, there are subtle differences depending on the context:

Read also:Hampton Inn Hudson Valley Ny A Premier Stay In The Heart Of New Yorks Scenic Region

Contextual Differences

- Routing Number: This term is more commonly used in modern banking and is widely recognized by consumers.

- ABA Number: This term is more technical and is often used in financial industry documentation and regulations.

In practice, both terms refer to the same nine-digit code used to identify banks and process transactions. The distinction is primarily one of terminology rather than function.

How to Find Your Routing Number

Finding your routing number is a straightforward process. Here are several methods you can use:

Methods to Locate Your Routing Number

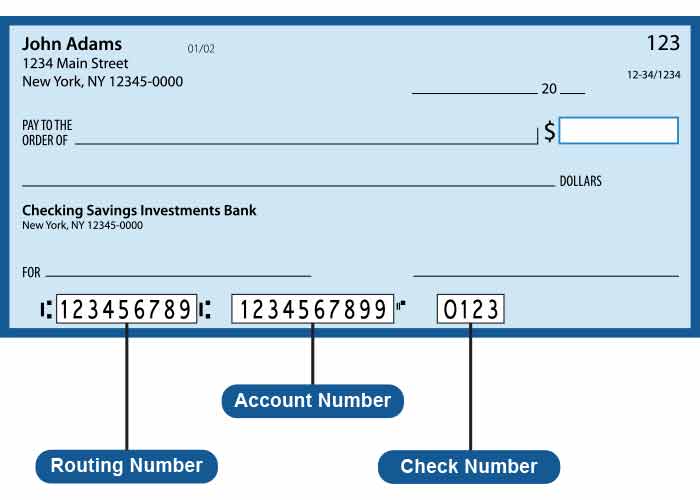

- Check the Bottom of Your Checks: The routing number is typically the first set of numbers at the bottom of your checks.

- Bank Statements: Your routing number may also be listed on your bank statements.

- Bank's Website: Many banks provide routing numbers on their official websites.

- Customer Service: You can contact your bank's customer service department for assistance.

Using these methods, you can easily locate your routing number and ensure accurate transactions.

Importance of Routing Numbers

Routing numbers play a critical role in the financial system. They ensure that funds are directed to the correct financial institution, preventing errors and delays in transactions. Here are some key reasons why routing numbers are important:

Key Importance

- Accuracy: Routing numbers ensure that transactions are processed accurately and efficiently.

- Security: They provide a layer of security by verifying the identity of the financial institution involved in the transaction.

- Efficiency: Routing numbers streamline the process of transferring funds between banks.

Without routing numbers, the financial system would face significant challenges in processing transactions effectively.

ABA Number Usage

ABA numbers are primarily used for domestic transactions within the United States. They are essential for various types of financial transactions, including:

Common Uses of ABA Numbers

- Direct Deposits: Employers use ABA numbers to deposit employee salaries directly into their bank accounts.

- Bill Payments: Consumers can use ABA numbers to set up automatic bill payments.

- Wire Transfers: ABA numbers are used to facilitate wire transfers between banks.

By understanding the various uses of ABA numbers, you can better manage your financial transactions and ensure they are processed smoothly.

Common Mistakes to Avoid

When dealing with routing and ABA numbers, it's important to avoid common mistakes that could lead to transaction errors. Here are some pitfalls to watch out for:

Mistakes to Avoid

- Incorrect Number Entry: Double-check the routing number before initiating a transaction.

- Using the Wrong Number: Ensure you're using the correct routing number for the specific type of transaction.

- Ignoring Updates: Stay informed about any updates or changes to your bank's routing number.

By being vigilant and attentive, you can avoid these common mistakes and ensure your transactions are processed without issues.

Frequently Asked Questions

FAQs

Q: Are routing numbers and ABA numbers the same?

A: Yes, routing numbers and ABA numbers refer to the same nine-digit code used to identify banks and process transactions.

Q: Can I use my routing number for international transactions?

A: Routing numbers are primarily used for domestic transactions within the U.S. For international transactions, you may need a SWIFT code instead.

Q: How do I find my routing number if I don't have checks?

A: You can find your routing number on your bank's website, your bank statements, or by contacting customer service.

Historical Background of Routing Numbers

The history of routing numbers dates back to 1910 when the American Bankers Association introduced the system. Initially designed to streamline check processing, routing numbers have evolved to accommodate modern banking practices, including electronic transactions and ACH transfers.

Evolution of Routing Numbers

- 1910 Introduction: ABA routing numbers were first introduced to facilitate check processing.

- Modern Applications: Today, routing numbers are used for a wide range of financial transactions, including ACH transfers and wire transfers.

The evolution of routing numbers reflects the changing landscape of the financial industry and the increasing importance of digital transactions.

Conclusion

In conclusion, understanding whether a routing number is the same as an ABA number is crucial for managing your finances effectively. Both terms refer to the same nine-digit code used to identify banks and process transactions. By familiarizing yourself with routing numbers, their uses, and how to locate them, you can ensure that your financial transactions are processed accurately and efficiently.

We encourage you to share this article with others who may benefit from this information. If you have any questions or feedback, feel free to leave a comment below. Additionally, explore other articles on our website for more insights into personal finance and banking.

References:

- FDIC.gov - "Routing Numbers and ABA Numbers"

- ABA.com - "History of Routing Numbers"

- Federal Reserve - "Guidelines for ACH Transactions"