Understanding VA state tax is crucial for every resident and business owner in Virginia. Whether you're filing your personal income tax, paying sales tax, or managing property tax, having a clear grasp of the state's tax structure can help you make informed financial decisions. This guide aims to provide detailed insights into Virginia's tax system, ensuring you're well-prepared for tax season.

Taxes play a significant role in funding public services, infrastructure, and essential programs that benefit the community. In Virginia, the state tax system is designed to ensure equitable contributions from its residents and businesses. By understanding the different types of taxes and their implications, taxpayers can better manage their finances and avoid unnecessary penalties.

This article will explore everything you need to know about VA state tax, including income tax rates, sales tax, property tax, and other relevant taxes. We'll also discuss how these taxes impact individuals and businesses, along with tips for effective tax planning. Let's dive in!

Read also:Cowboys Coaches Over The Years A Comprehensive Timeline And Analysis

Table of Contents

- Introduction to VA State Tax

- Virginia Income Tax

- Virginia Sales Tax

- Virginia Property Tax

- Virginia Business Tax

- VA Tax Filing Process

- Tax Exemptions and Credits

- Virginia Tax Deadlines

- Common Tax Questions

- Conclusion and Call to Action

Introduction to VA State Tax

Virginia's tax system is structured to provide revenue for state and local governments while ensuring fairness and transparency. The state collects taxes on various levels, including personal income, sales, property, and businesses. Understanding the basics of VA state tax is essential for both individuals and companies operating within the state.

Why is VA State Tax Important?

State taxes contribute significantly to funding public services such as education, healthcare, transportation, and public safety. For residents, paying taxes ensures access to these vital services. Additionally, businesses benefit from a stable infrastructure and a well-educated workforce, which are partly supported by state tax revenues.

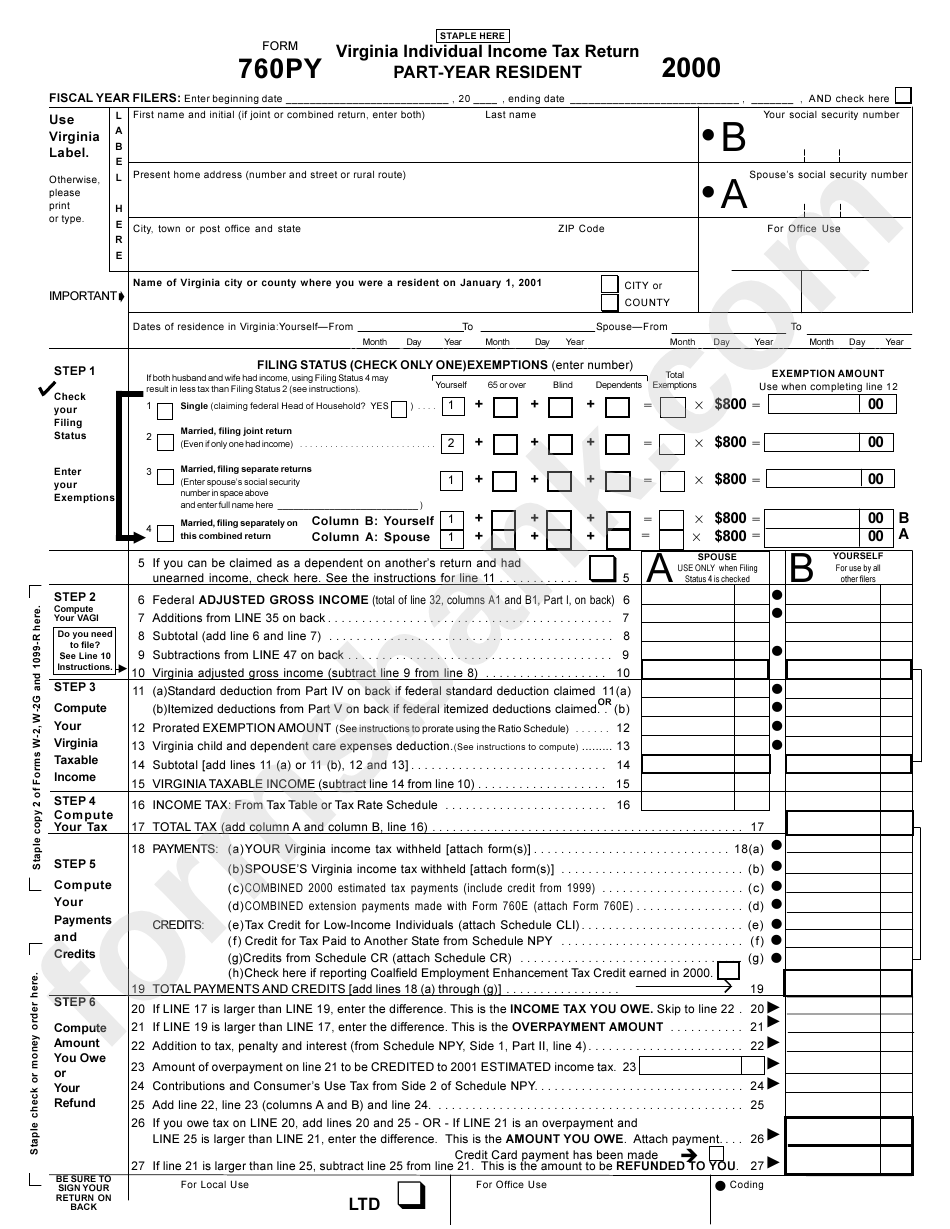

Virginia Income Tax

Virginia imposes an income tax on its residents, which is calculated based on a progressive tax rate system. The state's income tax structure is designed to ensure that taxpayers contribute according to their ability to pay.

Income Tax Rates in Virginia

As of 2023, Virginia's income tax rates are as follows:

- 2% on the first $3,000 of taxable income

- 3% on income over $3,000 up to $5,000

- 5% on income over $5,000

These rates apply to both single filers and married couples filing jointly. For example, if your taxable income is $10,000, you would pay:

- $60 on the first $3,000 (2%)

- $60 on the next $2,000 (3%)

- $250 on the remaining $5,000 (5%)

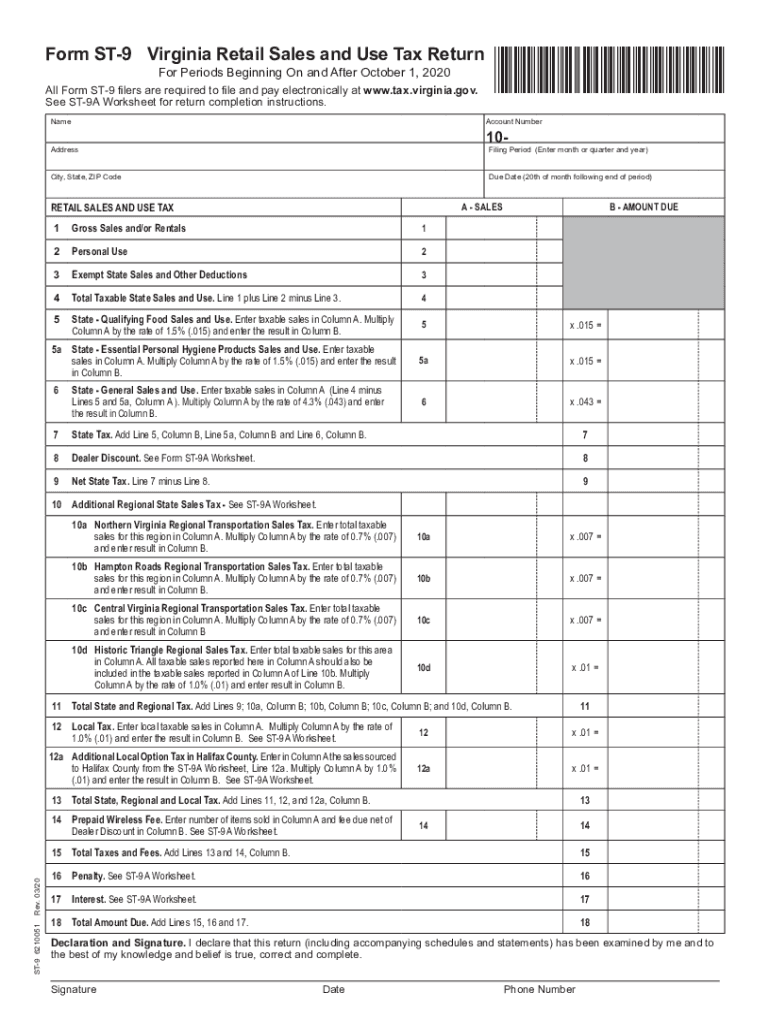

Virginia Sales Tax

The Virginia state sales tax is currently set at 4.3%. However, local jurisdictions may impose additional sales taxes, bringing the total rate to as high as 6% in some areas. Sales tax is applicable to most goods and services, with a few exceptions such as groceries and prescription medications.

Read also:Who Sang The Song Red Red Wine A Comprehensive Guide To The Iconic Song And Its History

Special Sales Tax Zones

Certain regions in Virginia, such as Northern Virginia and Hampton Roads, have special sales tax zones. These zones may have higher tax rates to fund specific projects or services. For instance, the Northern Virginia region has a sales tax rate of 6% due to the additional 1.5% local tax.

Virginia Property Tax

Property tax in Virginia is levied at the local level and varies depending on the jurisdiction. The tax is assessed based on the property's assessed value, which is determined by local assessors. Property owners are required to pay these taxes annually or semi-annually.

How Property Tax is Calculated

The property tax rate, also known as the millage rate, is multiplied by the assessed value of the property to determine the tax owed. For example, if the millage rate is 10 mills (0.01) and the assessed value of your home is $200,000, your property tax would be $2,000.

Virginia Business Tax

Businesses operating in Virginia are subject to various taxes, including corporate income tax, franchise tax, and sales tax. The state offers several incentives and credits to encourage economic growth and development.

Corporate Income Tax Rates

Virginia's corporate income tax rate is a flat 6% on taxable income. However, businesses may qualify for tax credits or deductions that can reduce their overall tax liability. It's important for businesses to consult with a tax professional to ensure compliance and maximize savings.

VA Tax Filing Process

Filing your Virginia state tax return is a straightforward process, thanks to the availability of online filing options. Residents can use the Virginia Department of Taxation's website or third-party tax preparation software to file their returns.

Steps to File Your VA Tax Return

To file your VA tax return, follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Calculate your taxable income and deductions.

- Choose the appropriate filing status (single, married filing jointly, etc.).

- Submit your return electronically or by mail before the deadline.

Tax Exemptions and Credits

Virginia offers several tax exemptions and credits to help taxpayers reduce their tax burden. These include exemptions for senior citizens, veterans, and disabled individuals, as well as credits for education, energy efficiency, and childcare expenses.

Eligibility for Tax Credits

To qualify for tax credits, taxpayers must meet specific criteria, such as income limits or specific expenses. For example, the Virginia Education Improvement Scholarship Tax Credit Program allows taxpayers to claim a credit for contributions made to qualified scholarship organizations.

Virginia Tax Deadlines

It's crucial to be aware of the tax deadlines to avoid penalties and interest. The Virginia state income tax deadline typically aligns with the federal deadline, which is April 15th. However, extensions can be requested if needed.

Penalties for Late Filing

Failing to file your tax return on time can result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax at the rate of 6% per year.

Common Tax Questions

Many taxpayers have questions about Virginia state tax, especially regarding deductions, credits, and filing requirements. Here are some frequently asked questions:

Can I Deduct State Taxes on My Federal Return?

Yes, taxpayers can deduct state and local taxes on their federal return under the SALT (State and Local Tax) deduction. However, there is a cap of $10,000 on the total deduction for state and local income, sales, and property taxes.

Conclusion and Call to Action

In conclusion, understanding VA state tax is essential for managing your finances effectively and complying with state regulations. By familiarizing yourself with the different types of taxes, rates, and deadlines, you can avoid penalties and make the most of available credits and exemptions.

We encourage you to take action by reviewing your tax situation, consulting with a tax professional if needed, and sharing this article with others who may find it helpful. For more information on Virginia state tax, visit the Virginia Department of Taxation's website or explore other resources available online.